5 Importance of Risk Management

Risk management is a critical facet of any organization’s operations. It involves the identification, assessment, and mitigation of potential risks that could negatively impact business objectives. The significance of risk management spans across multiple domains, influencing decision-making, financial stability, regulatory compliance, and more.

Enhanced Decision Making

At its core, risk management empowers decision-makers by providing crucial insights into potential risks and their possible impact. By analyzing risks, businesses can make informed choices, minimizing unforeseen negative consequences and optimizing outcomes. Strategic planning becomes more effective when rooted in a thorough risk assessment process.

Financial Stability

One of the primary reasons for integrating risk management into organizational strategies is its role in ensuring financial stability. By identifying and mitigating potential risks, businesses safeguard their financial resources and assets. For instance, risk management in investment portfolios helps in diversification and reducing potential losses during market fluctuations.

Regulatory Compliance

In today’s complex regulatory landscape, adherence to laws and regulations is paramount for businesses. Effective risk management ensures that organizations operate within legal boundaries, minimizing the risk of penalties or legal issues. Non-compliance can have severe repercussions, including damage to reputation and financial losses.

Business Continuity and Resilience

In an unpredictable world, risk management plays a pivotal role in maintaining business continuity and resilience. By anticipating and preparing for potential disruptions, organizations can effectively navigate crises and ensure minimal downtime. The ability to bounce back from setbacks is a testament to the strength of risk management strategies.

Enhanced Reputation and Trust

Trust is the bedrock of any successful business. Implementing robust risk management practices builds confidence among stakeholders—customers, investors, and partners. Moreover, in times of crisis, an organization that handles risks adeptly can emerge stronger, reinforcing trust in its ability to weather challenges.

Crisis Prevention and Management

Risk management is not merely about reacting to crises but also about preventing them. Through comprehensive risk assessments, organizations can identify potential threats and take proactive measures to mitigate them. Furthermore, having crisis management strategies in place enables swift and effective responses when emergencies arise.

Innovation and Growth

Strategic risk-taking is integral to innovation and growth. Risk management fosters an environment where calculated risks are encouraged, enabling organizations to explore new opportunities while minimizing potential downsides. It acts as a catalyst for innovation and fuels sustainable growth.

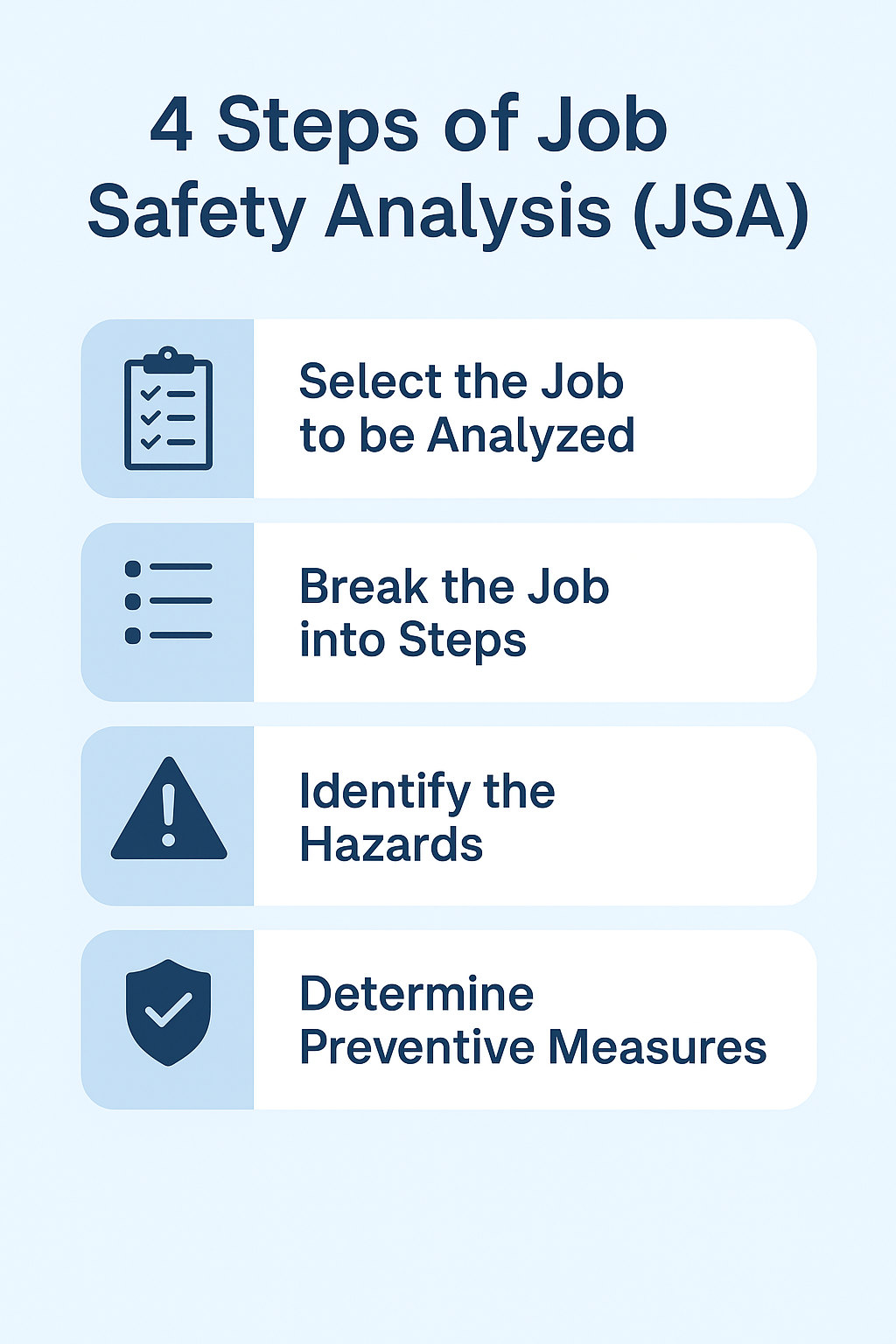

Human Resources and Workplace Safety

A safe and secure workplace is essential for employee well-being. Risk management extends to ensuring workplace safety, mitigating risks associated with accidents or health hazards. Prioritizing employee safety not only fosters a positive work environment but also minimizes potential liabilities for the organization.

Technology and Cybersecurity

In the digital age, technological risks and cybersecurity threats pose significant challenges. Effective risk management practices encompass strategies to safeguard against data breaches, technological failures, and cyber threats. Protecting sensitive information is crucial for maintaining trust and credibility.

Environmental Impact and Sustainability

Acknowledging and managing environmental risks is imperative for sustainable business practices. Organizations embracing risk management evaluate environmental impacts, aiming for sustainable operations and minimizing ecological footprints. This proactive approach aligns with societal expectations and fosters a positive brand image.

Risk management is crucial for various reasons:- Protection against Losses: It helps businesses and individuals anticipate potential threats and take proactive measures to mitigate them. By identifying risks early, they can reduce the impact of adverse events, preventing significant financial losses or other setbacks.

- Decision Making: Effective risk management provides valuable insights for informed decision-making. Understanding potential risks allows for better evaluation of options and choosing strategies that minimize negative consequences.

- Business Continuity: Managing risks ensures continuity in operations. By having contingency plans in place, organizations can better navigate unexpected events, maintain services, and prevent disruptions to their business activities.

- Compliance and Governance: Many industries have regulatory requirements for risk management. Adhering to these standards not only ensures legal compliance but also promotes better governance practices within organizations, fostering transparency and accountability.

- Enhanced Reputation: A proactive approach to risk management demonstrates responsibility and reliability. Companies that effectively manage risks often gain trust and confidence from stakeholders, including customers, investors, and partners, thereby enhancing their reputation in the market.

Overall, risk management isn't just about averting disasters but is also a strategic tool for improving decision-making, ensuring business continuity, meeting regulatory obligations, and maintaining a positive image in the eyes of stakeholders.Conclusion

In conclusion, the importance of risk management cannot be overstated across various sectors. From enhancing decision-making to ensuring financial stability, regulatory compliance, and fostering innovation, its role is multidimensional. Embracing a proactive approach to risk management empowers organizations to navigate uncertainties, safeguard assets, and thrive in an increasingly complex business environment.

FAQs about Risk Management:

- Why is risk management crucial for businesses?

- Risk management helps businesses anticipate potential threats, make informed decisions, and safeguard against financial losses.

- What are the consequences of neglecting risk management?

- Neglecting risk management can lead to financial losses, regulatory issues, damage to reputation, and disruptions in business continuity.

- How does risk management contribute to innovation?

- Risk management encourages calculated risk-taking, fostering an environment conducive to innovation and growth.

- Is risk management only relevant for large corporations?

- No, risk management is essential for businesses of all sizes as it helps in identifying and mitigating potential risks regardless of scale.

- Can risk management practices evolve with changing times?

- Absolutely, risk management continually evolves, incorporating new technologies and strategies to address emerging risks and challenges.